Thank You!

Your special report "5 Best Stocks to BUY NOW" was just emailed to you. It usually takes 5-10 minutes to arrive. If you don't see it in your inbox, please check your spam folder.

In the meantime, you should read the important message below from Cabot's Chief Investment Strategist Mike Cintolo, on how to consistently find the top growth stocks in today's market...

Every two weeks, I release an in-depth special stock report sharing my exact buys and sells on the best high-potential growth stocks

And right now you can get access for less than $2 per week

In the more than 50 year since we started this publication we’ve brought investors like you many big winners

Including 400%+ winner on Facebook post-IPO…

1,290% winner on Amazon, 746% on Apple…

…dozens of triple-digit winners from big and small stocks

Thank you for requesting my report on the top 5 stocks stock to buy now.

My goal with each pick that lands on my watchlist is to answer this one question --- “Is there future growth behind this stock?”

Not just in the price…

But the company.

For the last 25 years, I’ve quietly put together one of the best growth stock portfolios in the business.

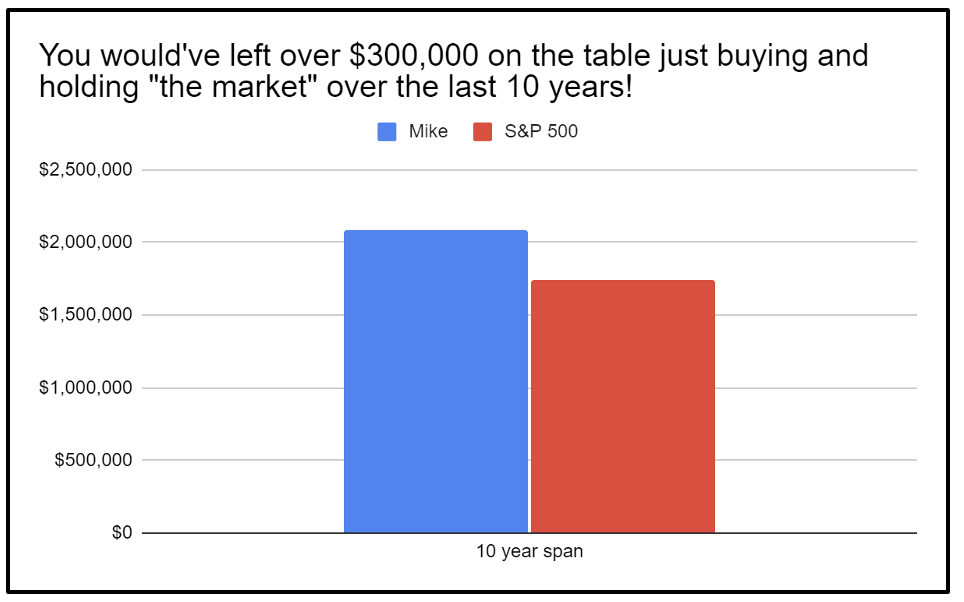

In fact, over the last decade… from 2010 through 2020… you could’ve made over $1.5 million dollars of profit on my picks..

That’s including winners and losers.

You would’ve ridden Facebook’s IPO to 400% gains…

DocuSign 194% gains in less than a year…

180% winner on Teladoc as Covid ramped up…

Nutanix climbed 97% in less than 7 months as the AI trend surged into 2024…

And those are just to name a few of the dozens of double- and triple-digit winners I’ve put together in my bi-weekly report you can get right now.

Don’t get the wrong impression – not all of my recommendations are winners, and they don’t all show 100%, 400% or 1200% returns. But …

If you had started following my growth stock picks at the start of 2010… with a good sized portfolio of $500k+...

You could be comfortably retired by now. Sitting on millions of dollars.

If you started with less… you still would’ve 4X’d your money and handily beat the market.

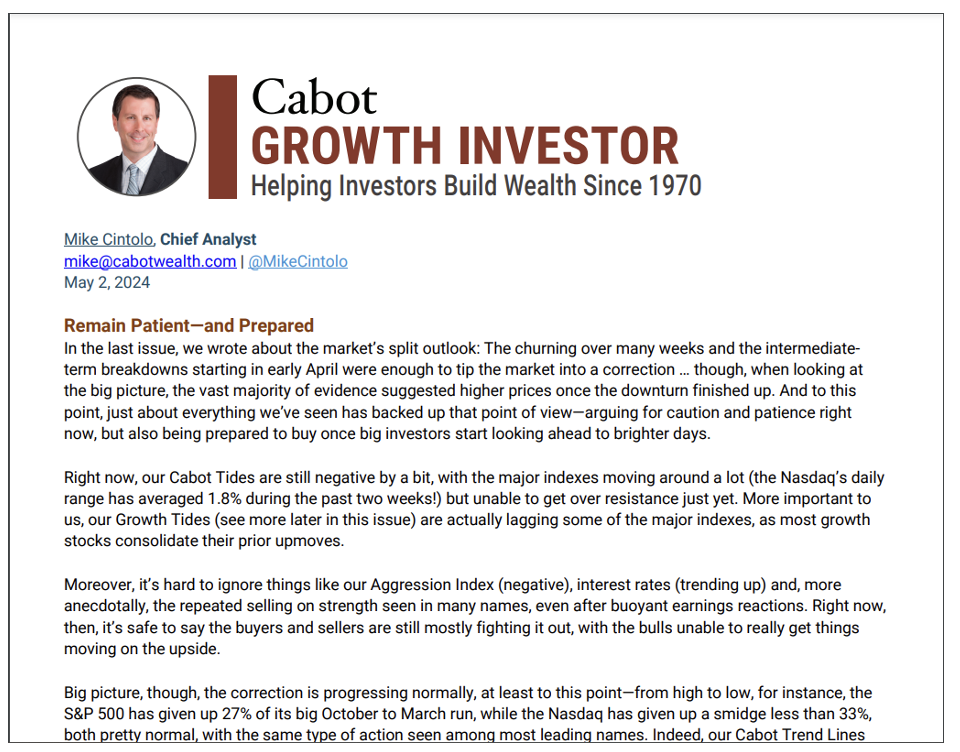

You can follow every single pick with my bi-weekly report called Cabot Growth Investor

Cabot Wealth Network is a financial publisher that has helped more than a million investors since 1970.

I’ve been an analyst here since 1999 with a focus on growth opportunities.

That means buying a stock, holding it, riding it up, then selling.

I’m not day trading… and not trading options.

Instead, I’m treating the portfolio… your portfolio… like a money manager.

We’re looking to buy low and sell high. Even if we still have faith in a name or believe the market will go up again…

We want to only buy and hold at great prices.

Compare that to blind ‘buy and hold’ investors…

We’re not buying and holding stocks through the rough patches.

For example, during the November 2025 pullback…

We were sitting in 70%+ cash. We had sold as the market euphoria peaked during October… and retreated to cash.

Even many personal finance gurus would say ‘that’s impossible to do well long-term.’

But they’re wrong. I’ll show you today…

And you can join me each month doing so…

you can find the best growth names (I call them ‘emerging blue chips’) and run with them for triple digit gains in any market.

Yes, we sell them at times.

That doesn’t mean we still don’t believe in our core positions… it’s taking profits and then re-buying it at better prices.

Now, like I said --- many would say this is impossible to do… “You can’t time the market.”

I’ve been doing it for decades.

Following my picks over the last decade could’ve resulted in gains of $1.5M.

$1,566,257 for exact numbers.

If, instead, you decided to ‘buy and hold’ the S&P 500 like most personal financial experts suggested… you would’ve left over $300k on the table in that same exact timeframe starting with the same $500k.

There’s 6-figures of profits potentially on the line by doing nothing today

That’s nearly $30k per year of profit lost each year for not taking advantage of how I recommend buying stocks.

And let me be clear about something…

Most people, even hedge funds, DO NOT even beat the market each year.

I’d challenge most people who read this page to show me their hand-picked stocks over the last 10 years… and I bet most didn’t beat the market.

I beat the market… by an impressive margin.

We’re talking hundreds of thousands of dollars.

And you can start doing it yourself…

Every 2 weeks…

Not a lot of time at all…

Crack open Cabot Growth Investor:

I go through:

- The current market trend

- What % I’m in cash and equities

- Stocks that are trending and on my watchlist

- Buy and sell recommendations as they happen

No, it’s not a ‘day trading’ newsletter.

It’s a complete growth portfolio to get you into the best growth names happening right now.

Do it starting today and you’ll start hitting winners like:

- American Medical, +639%

- Archer Daniels, +100%

- Beech Aircraft, +270%

- WD-40, +173%

- MCI Communications, +240%

- General Public Utilities, +151%

- SafeCard, +206%

- Triangle Industries, +112%

- Amazon, +1,290%

- American Power Conv., +1,075%

- Ascend Communications, +440%

- Home Depot, +239%

These are some of my big winners, some with gains of more than 1,000%. Not all gains are as big. And there are losers too.

If you can buy stocks set to be the next Netflix, Tesla, Facebook, Alibaba… those winners more than make up for any losses.

I didn’t come from Wall Street…

Everything I learned about stocks, I learned from trial and error – successes and failures.

I’ve built dozens of stock indicators that didn’t work... (except one…which we’ve used for the last three decades and you can get access to as a free bonus)

You couldn’t pry me away from the stock screeners.

Regularly, I’d be in the office trying to create the perfect indicator..

None worked… so I’d try over and over again.

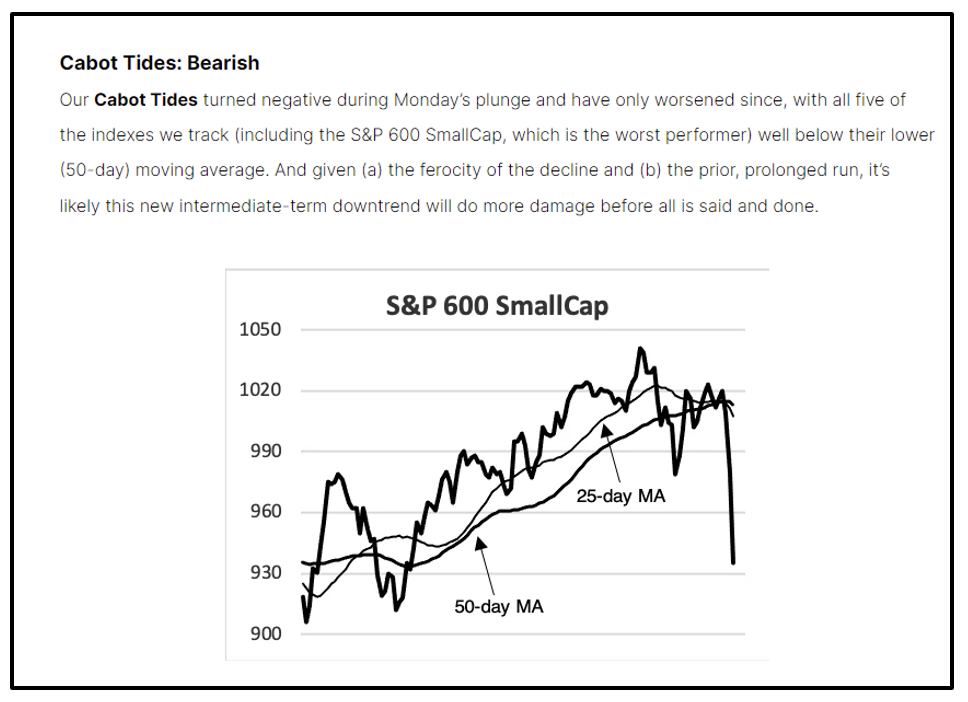

Finally, I built one indicator that did work! It gave me the signal on whether the intermediate trend of the market was bullish or bearish.

When bullish, I’d put more cash to work.

Bearish? Trim positions and sell others to raise cash just in case.

The analyst team here at Cabot has now used this proprietary indicator for the past 25 years. I’ll give you access to this indicator as a free bonus with your Cabot Growth Investor report in a minute.

One of my top picks that propelled me into the spotlight was a 1,075% win on American Power Conversion.

It’s a power company that was eventually acquired in 2008 and now long gone.

That one pick would’ve turned $10,000 into over $117,500.

Or $20,000 into $235,000.

This pick was my big break.

Ever since then, I’ve honed and made my strategy better.

The strategy is simple… find what I call “emerging blue chips”, buy them, ride them for max gains… then sell.

It took me years to discover how it’s possible to get these types of big winners:

- JDS Uniphase, +387%

- Qualcomm, +559%

- Summit Technology, +443%

- Yahoo, +316%

- Apple, +746%

- Crocs, +307%

- eResearch, +257%

- Expedia, +105%

- First Solar, +415%

- Net Ease, +200%

- TASER, +296%

- XM Satellite Radio, +396%

To be clear, that’s not to say you aren’t holding some of these stocks for a year or two. You might be.

I’m not anti-buy and hold.

You simply need to understand how the market works.

A stock you buy and hold that moves sideways ties up assets that aren’t growing for you. To maximize profits we trim or exit a position that is going nowhere and reinvest the proceeds more productively.

If the stock starts to move again, we may buy back in again later.

We know when to strike with our Cabot Trend Lines.

To win at buying momentum… you need to know WHERE the market is at all time

I have a special, proprietary indicator I built that gives us these signals

And you can get access to this indicator (and more) in every single bi-weekly issue of Cabot Growth Investor

For free.

Here’s how they work:

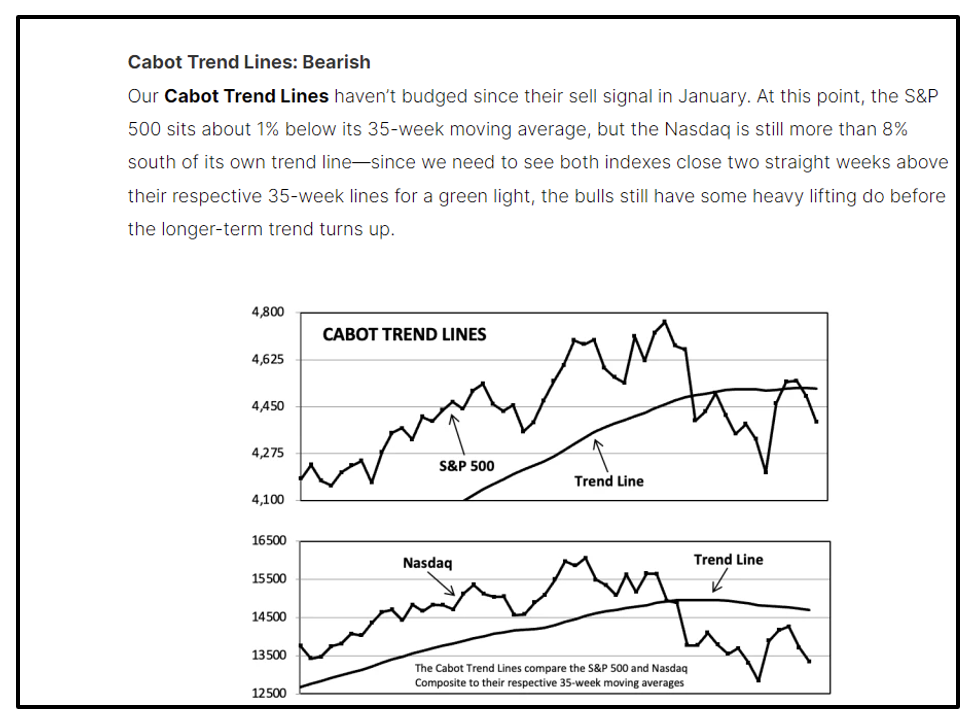

CABOT TREND LINES:

Cabot Trend Lines is our proprietary long-term trend signal telling us if there is a potential, prolonged bull or bear market in play.

For example…

Post-Covid, we saw stock prices moon into mid-2021. As the year ended, the market peaked and tech (especially) dumped fast.

Our long-term Trend Line signal flipped in January 2022 alerting us that, “hey, we could be entering a multi-month bear market.”

Not a two-week correction… no, a longer term pullback.

Sure enough…

2022 was a bloodbath with the S&P 500 losing 20%. (Cabot Growth Investor beat the market in 2022 as well).

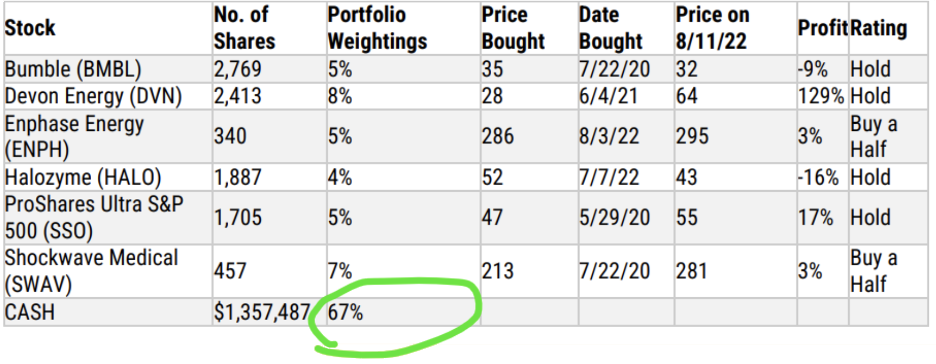

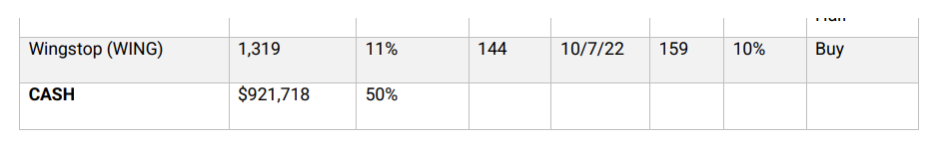

Note: Recommendations above are from August 11, 2022

We moved to 67% cash in 2022 as the market sank. Notice we had some newer 2022 picks but also some longer term holds from 2020-2021 including a 129% winner in energy (DVN).

When we’re in a longer term bear market, I move subscribers to cash. Fast. Here’s just a snapshot of mid-2022:

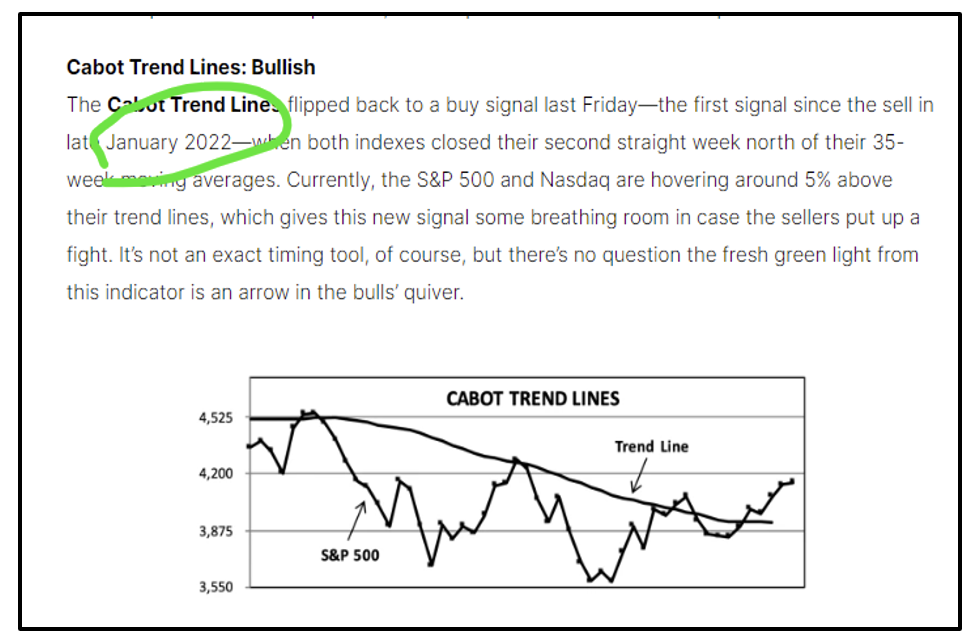

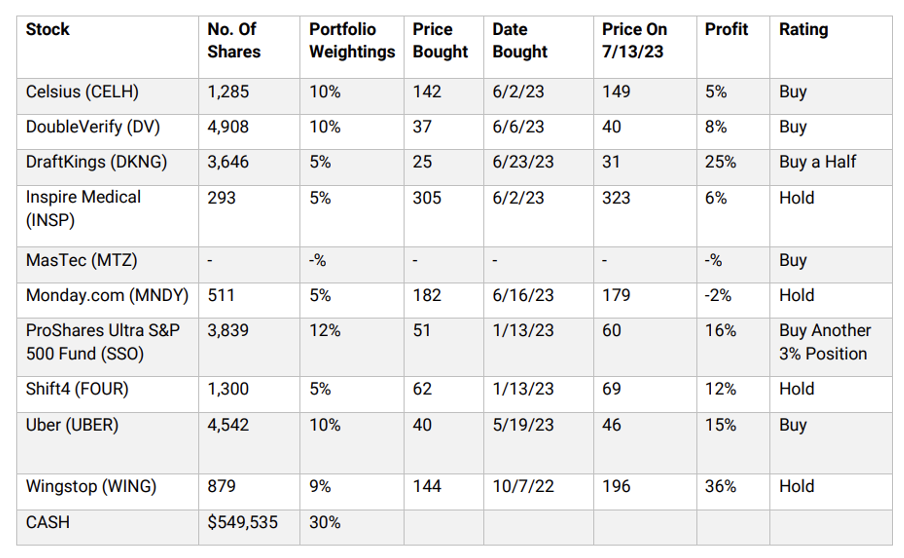

As the market bottomed out into 2023…

Cabot Trend Lines suddenly flipped in early February 2023…

By early February, we went from 67% cash to 50%...

By July… it was only 30% cash.

With tons of double-digit profits held on the year.

But it doesn’t stop there.

How did I know when to go to 70% cash in November 2025?

That’s another proprietary indicator you can check in every bi-weekly issue of Cabot Growth Investor.

Much like when you need to change direction in a car… you slow down first…

Cabot Tides is the intermediate signal to start trimming, selling and holding positions. No buying.

During the first ripples of the Covid crash in late February…

Our Tide signaled an intermediate reversal happening.

I immediately sprang into action with subscribers.

We trimmed/held some positions…

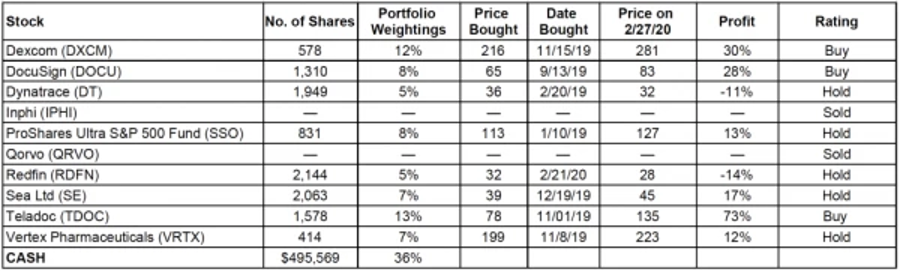

Then sold a handful of others. Here’s a peek at the portfolio as it was February 2020 before the lockdowns.

Cabot Tides is the first indicator to immediately pause buying at the first sign of bearish signals… and to trigger new buying in bull markets.

These two proprietary market indicators are freely seen inside every issue of Cabot Growth Investor.

Access to proven indicators like these will cost you around $300 per year on their own…

You get them for free as a subscriber.

They’re in every issue and update of Cabot Growth Investor.

You get access for less than $2 per week.

Every issue… I’m highlighting the top ‘emerging blue chips’

This is the secret I use that could’ve net you potentially $1.5 million in profits over the past decade…

Find these ‘emerging blue chips’ in 3 steps:

Follow these 3 criteria and you could be in the next emerging blue chips:

#1. Only buy stocks with a good fundamental story (this forecasts future growth)

Story and emotion drives stocks. There’s a reason a meme stock like Gamestop went ballistic in 2021 despite the company running on fumes.

Take our 2023-2024 pick of Nutanix. It doesn’t get a lot of press, but if you dig into the story… it’s hard not to love it.

Nutanix is a key cog for the massive IT assets of blue chip companies. They allow these big companies to run every app and piece of tech on the cloud. Recently, one of its largest competitors got bought out… plus Nutanix runs on a subscription model (i.e. recurring revenue) and this stock was set to move.

I recommended Nutanix in early November, 2023…

By the end of May 2024, the stock was up 97% in just under 7 months!

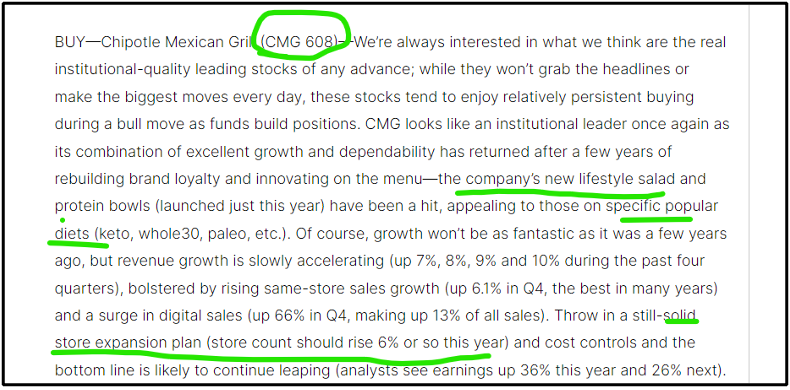

Chipotle (CMG). Yeah, the burrito place. Also quietly one of the best stocks to own over the last 5 years.

Look where I recommended it… at the bottom of 2019.

My thesis?

Check out what I wrote in February 2019:

Chipotle attacked the booming ‘keto’ and ‘paleo’ diets as they took over.

Plus, Chipotle was still expanding stores even as it neared its 30-year anniversary. That’s always a bullish ‘blue chip’ sign.

We bought the stock at $608. If you held, it hit over $3,200 in 2024.

#2: The ‘emerging blue chip’ has earnings growth

Solid earnings growth shows the company is growing and producing more cash. More cash means potential for faster growth.

After all, a company can’t grow much if there’s no leftover cash after the bills get paid.

Check out Nutanix’s’s earnings growth leading up to our buy in November 2023.

Their revenue had doubled over 5 years and they had seen their earnings hit the best they ever had in July 2023—and this says nothing about free cash flow, which given the company’s subscription business model, was much larger than earnings. A major green flag.

Look at Chipotle.

Their burritos and bowls print money.

We got in while their earnings TRIPLED.

You’d think there’d be a slowdown from there… nope.

Profits doubled from that point in 2023. They were superstars during Covid while other restaurants closed their doors for good.

This cash cow paid off investors handsomely and we got our part of that.

#3: You’re getting in at a great entry point: (buy low…before we sell high)

You can’t force the market to do anything.

Like a batter in baseball… wait until you get a good pitch. Swinging at good pitches outside your ‘strike zone’ is a surefire way to see low --- even negative --- returns.

Let’s look at Nutanix’s entry.

The company’s earnings had been doing better… but the stock was still choppy.

I waited.

I waited patiently until the stock breaks out of a 3-month base and the price goes higher. The stock also popped above the 40-day moving average (one of my favorite moving averages to follow).

Why buy on the breakout?

Because it’s proven stocks that break out of resistance tend to go higher, much faster. Of course, some breakouts fail, so you get out. Even if earnings look good, you get out.

You’ll see a breakout setup like Nutanix all over the markets, every day. The key is making sure those stocks have a great story and growing earnings to go along with it.

Better earnings and story means more institutional money will follow for the long-term. That will naturally nudge the stock higher.

Like Chipotle. Earnings growing, stores opening, catering to popular diets…

Now, how about the entry point…

CMG stock was breaking out to the highest price since 2016. That’s bullish.

Even with growing earnings, Chipotle’s stock was taking a dive for 4+ years. Imagine holding the stock during that period. The lost returns are sickening.

You can find the pattern many times on charts.

When all 3 of these criteria line up… you’re in potential ‘blue chip’ land.

#1. The stock tells a good story

#2. The stock is seeing earnings growth

#3. The stock is looking ready to pop to the up side.

The key point is making huge profits from ‘emerging blue chips’ isn’t a buy and hold proposition.

Your portfolio is a living, breathing machine.

You’re always adding and trimming your positions 1-2x per week.

Every issue (24 times per year)...

I’m sharing:

- New fundamental growth stories

- Stocks with incredible buy points

Imagine getting this type of deep, non-biased analysis to your inbox all year.

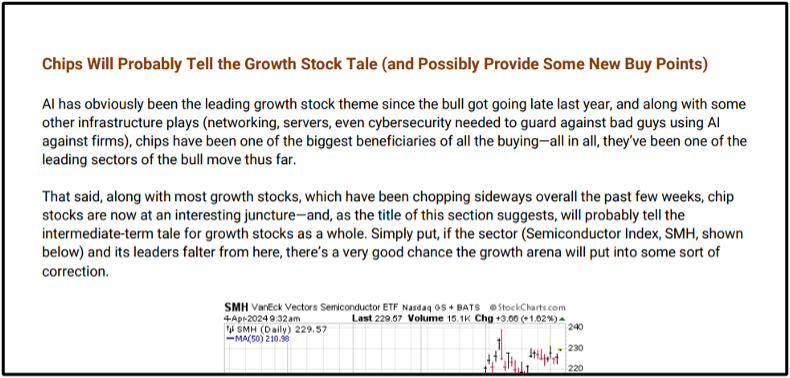

Here I’m talking about AI and the growth in chips required.

A fundamental story that’s igniting potential huge growth in the market. Which is how you see a stock like QBTS go up 201% in 12 months in 2025.

These types of killer finds…

Each issue I’m breaking down the stories… and you get the entry points.

These bi-weekly issues (for just $2 per week) are housed inside my flagship service, Cabot Growth Investor.

Get access to my Growth Portfolio…

One that I grew past $2,000,000 the past decade…

Cabot Growth Investor is 55 years old with one of the strongest track records you’ll find in the space.

Our goal is simple --- Find the top performing stocks in every sector, with growing earnings… and buy them as they breakout to the upside.

We look to hold no more than 10-12 stocks at one time so it’s easy to manage.

You’ll add to your positions.

You’ll trim as they top out or break down.

You’ll run to cash and hold fewer positions when the boats get rocky.

We’re not just focused on ‘tech’ stocks. If oil is hot, we’re in oil stocks… If metals are hot, commodity plays are the call.

You’ll be in the markets with the top 1-2 hottest stocks in the hottest sectors.

Our hope is we can buy and hold a growth stock for years to come. But, if a trade only lasts for 10 months, we’re okay too.

Here’s what you can expect inside your new subscription to Cabot Growth Investor:

- Bi-weekly issues with full 12-15 page write-ups: Many other stock newsletters out there are monthly. You’ll get 24 issues per year.

Each issue contains:

- My breakdown of the markets for the past 2 weeks. Get my take on the Federal Reserve’s interest rate, breaking news out of economic reports, what sectors are hot or not… and more.

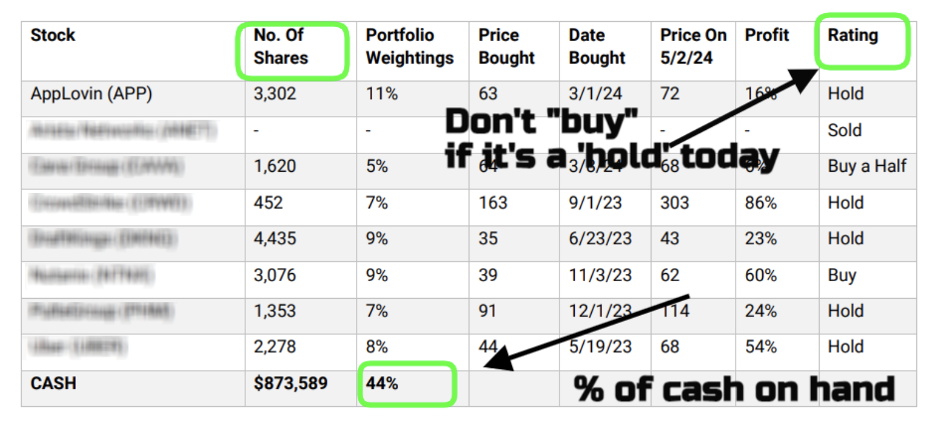

- See my Model Portfolio with actual recommendations of what to do now… plus, how many shares I have in my portfolio .

Note: Current/recent holdings are concealed to be fair to existing subscribers. This is provided for example purposes only and recommendations on stocks shown may have changed since..

- Breakdown of every holding in our portfolio… why I’m bullish… why I’m buying, holding or selling. See the exact chart I’m watching for entries and exits.

- My current watchlist of potential future emerging blue chips:

- The HOT sector stories of the week: Discover which areas of the market are heating up, whether we should be watching to invest, and the good, bad and ugly.

These issues aren’t books.

They’re about 12 pages printed… you can read them on your phone, before work starts, or in the evening.

Quick, brisk reads that give you actual moves to make in your portfolio the following day.

Not only that…

You’ll be FAR ahead of other investors when it comes to changing winds in the market.

Since 1970…

At Cabot, we’ve become famous for predicting the trends of the market.

…from the bear markets of the 1970s…

…to the bull markets of the 1990s…

…to the tech bubble crash in 2001…

In 2007, Cabot Growth Investor returned an incredible 36.7% return to investors. Meanwhile, those invested in the market only eked out a 3.5% return.

We forecasted a rocky market ahead…

And went to (mostly) cash for months on end.

As we dipped our toes back in around 2008… I made the call to buy First Solar while everyone else still ran headfirst into real estate.

My readers and I netted a massive 415% return…

Then, we went to 90% cash. We didn’t double down on anything, we went to safe harbors.

Readers were pounding on my virtual doors (through email) demanding I explain myself.

“The market is still up… why are we sitting in cash?!?”

While the talking heads talked up a rally…

I was following our Cabot indicators I showed you already… the ones you get for free..

Mere weeks later… Lehman collapsed and armageddon ensued.

Those calls for my head turned to cheers as we again stomped the market in 2008 while many trading firms went belly-up.

Here are the main pieces you receive as part of your Cabot Growth Investor subscription.

I promise special reports, and you get them.

Included with your subscription, get these bonus reports:

- How to Handle Monster Stocks for Maximum Profits

- 10 Rules for Big Profits from Growth Stocks

- 7 Ways to Build & Protect Your Wealth

- Your Checklist for Identifying Your Next Growth Stock

All included absolutely free with your membership.

To get a seat inside… and a chance at the next $1.5 million dollar profit over the next decade…

You’d expect to pay $1,000 - $5,000 per year for this type of service.

We sell it right now for $497 per year.

Others already pay that and we’re contemplating raising the price to $1,000.

But, on this page only,

You can get a 1-year subscription to Cabot Growth Investor for just $79 today.

Right now. Only available through this special offer today.

After 12 months, you’ll auto-renew at the normal, market rate.

You’ve seen a ton of winners already:

- Beech Aircraft, +270%

- WD-40, +173%

- MCI Communications, +240%

- General Public Utilities, +151%

- SafeCard, +206%

- Triangle Industries, +112%

- Amazon, +1,290%

- American Power Conv., +1,075%

- Ascend Communications, +440%

- Home Depot, +239%

Just $1,000 into one of these picks would have paid off your subscription in a month!

That’s it.

I want this service to be a no-brainer as you dig up the next emerging blue chip.

For just $79, you get access to:

- 24 full, 12-14 page issues for the year with in-depth reports on our positions, including easy-to-read charts, with concise instructions on how to read them.

- Updates during special events like Fed day, earnings, etc. All included.

- Multiple bonus reports teaching you how I trade.

- Cabot Trend Lines and Cabot Tide indicators sharing with you which direction the market is moving in both the long-term and intermediate trends.

I believe these are easily worth over $1,000 in value…

You pay just $79 right now. For a full year!

If you want to take the 5 stocks I trade this month and put them into action…

Cabot Growth Investor is how… and it’s just $79

If you’re skeptical… Get 12 months to test it out on me!

To make it easier, I’ll also include my 12-month 100% money-back policy as a kicker.

If after 364 days, you aren’t satisfied with me or my firm, Cabot Wealth Network, email me for a full, 100%, no hassle refund.

It’s that simple. But I believe you’ll stick around for years to come.

I have readers that have been with Cabot Growth Investor since the 1970s. They pay the full price each year without complaint. That’s because of all the success we’ve had, and also the value you get.

To get started… and to get your first issue now… and many more over the next 12 months… click the ADD TO CART button below.

You’ll go to a secure checkout page to finish signing up for your subscription.

(Offer for new subscribers only)

With Cabot Growth Investor, you’re buying the best stocks in the best sectors right now.

When oil is out of favor… when tech is out of favor… you’re out. And on to the next thing.

Our Cabot Trend Lines and Cabot Tides proprietary indicators will shuttle you back to cash safely during the rough times.

Then, we’re re-deploying cash as the market smooths out.

At Cabot, we’ve done this since 1970.

I’ve been here since 1999 helping thousands of investors and have done it well. You’ve seen my track record.

Now, for just $79, you too can start getting my top growth stock picks… the ‘emerging blue chips’ which could pay you triple digit gains in your account…

Simply join Cabot Growth Investor today.

Click the button below to go to the checkout page.

You’re backed by my 365-day 100% money-back policy so you can get a refund at any point during your subscription.

Who knows…

Over the next 10 years, maybe you too could bank $1.5M in profits like you could’ve done following me the last 10 years.

I have open positions right now that could turn from “BUY” to “HOLD” by this week. Don’t miss this open position.

Click the button below and complete your subscription on the next page.

I’ll see you inside,

Mike Cintolo

Chief Analyst, Cabot Growth Investor

(Offer for new subscribers only)

If you prefer to order by phone, our customer service team is available at

1 (800) 326-8826 Monday-Friday, between 8:30 a.m. and 5:00 p.m. ET.

Our Guarantee

We strive to constantly earn your business every day. This approach has helped us become one of the highest rated and longest-established financial publishers in the industry.

We pride ourselves on our transparency and the quality of our investment services.

If on the rare chance you aren’t satisfied, simply email me within the first 30 days of your annual subscription for a full, no-questions-asked refund.

If you choose the annual plan, you’ll also get our 30-day 100% money-back guarantee after the trial converts. That’s 60 days to kick the tires, paper trade, or do whatever you like so you can be absolutely sure this service is right for you.